32+ Federal direct unsubsidized loan

Aggregate Loan Limit A limit on the total amount of. The Federal Direct Loan Program is.

How To Read Your Ridiculously Confusing Financial Aid Letter Financial Aid For College Financial Aid Scholarships For College

UEH flags 2 and 3 do not necessarily mean the student has improperly received Pell or Direct Loan funds but it is a sign of unusual activity for example receiving Pell andor Direct Loans at multiple schools in the same semester or receiving aid and then withdrawing before earning any credit.

. Ioannis Sakkas curious about whether Archimedes could really have destroyed the Roman fleet in 212 BC lined up nearly 60 Greek sailors each holding an oblong mirror tipped to catch the suns rays and direct them. Average Student Loan Balance. 1 The government protects farmers against fluctuations in prices revenues and yields.

And the introduction of the Direct Loan Program and phasing out of the Federal Family Education Loan Program also affected the cost of federal student loans. Here are the current repayment statuses of the federal Direct Loan program. The interest rates on federal student loans are among the lowest interest rates available to college students.

114th Congress Public Law 113 From the US. These loans are backed by the US. The CARES Act provided some relief for federal loan borrowers but it did not.

The amounts of any TEACH Grants Direct Unsubsidized Loans Direct PLUS Loans and non-federal non-need-based loans including private state-sponsored and institutional loans that are used to replace the EFC amounts that exceed the EFC must be treated as EFA. Even wealthy students will qualify for the unsubsidized Federal Direct Stafford Loan and the Federal Parent PLUS Loan. Ford Federal Direct Loans are by far the most common type of student loans with 328 million recipients borrowing a total of 7053 billion in 2017.

Eligible students can borrow up to 20500 per academic year from the Federal Direct Unsubsidized loan not to exceed an overall aggregate amount borrowed of 138500. Disadvantages of Federal Direct Loans. Direct unsubsidized loans for undergraduates.

I did try one insurance companys website direct and that did seem to work. If the package includes an Unsubsidized Direct Loan a Direct PLUS Loan or a nonfederal education loan and the aid package doesnt already apply these loans toward the EFC and the school so chooses the aid package can be adjusted so that all or some part of these loans replaces the EFC thus. Eligibility for Direct Unsubsidized Loan is determined by subtracting EFA.

More Learn What a Full-Time Student Is. The full unsubsidized premium is 11532 per year. Government Publishing Office Page 2241 CONSOLIDATED APPROPRIATIONS ACT 2016 Page 129 STAT.

How federal Direct Unsubsidized Loans work. The Federal Direct Loan Program is a federal program that provides low-interest loans to post-secondary students and their parents. Government so if a student defaults the government guarantees repayment to the lender.

The education loan is expected to grow at a rate of 323 per cent in 2009-10 and. Department of Educations central database for student aid. Federal student loan interest rates for the fall are determined by the 10-year Treasury note auction every May plus a fixed increase with a cap.

The federal government spends more than 20 billion a year on subsidies for farm businesses. Stafford loans also known as William D. Federal loans can be subsidized or unsubsidized Interest does not accrue on subsidized loans while the students are in school.

32 of 45. A federal student loan that youre not eligible to receive or default on your federal student loan. 2242 Public Law 114-113 114th Congress An Act Making appropriations for military construction the Department of Veterans Affairs and related agencies for the fiscal year ending September 30 2016 and for.

Federal student loan make a false statement that causes you to receive. Disadvantages of Federal Direct Loans. Between 1987 and 2010 several financial aid reforms were implemented including the introduction of unsubsidized loans and increased limits on some grants and subsidized loans.

Interest rates on Federal student loans reset annually on July 1 based on the last 10-year Treasury Note auction in May. February 11 2017 at 1113 am. The authors find that reforming the Federal Student Loan Program generated a 102 tuition increase.

Rose 106 on average. Over those 20-plus years net tuition in the US. The FAFSA is a Prerequisite for Federal Loans.

Direct Unsubsidized Direct Subsidized. Under the Teacher Loan Forgiveness Program if you teach full-time for five complete and consecutive academic years in a low-income school or educational service agency and meet other qualifications you may be eligible for forgiveness of up to 17500 on your Direct Subsidized and Unsubsidized Loans. 32 East 31st Street 4th Floor New York NY 10016.

Any loans prior to that date may be at a variable rate. About 39 percent of the nations 21 million farms receive subsidies with the lions share of the handouts going to the largest producers of corn soybeans wheat cotton and rice. The average balance increased by 326.

The new interest rate is. A legend has it that Archimedes used a burning glass to concentrate sunlight on the invading Roman fleet and repel them from SyracuseIn 1973 a Greek scientist Dr. Even if a student will not qualify for grants filing the FAFSA makes them eligible for low-cost federal student loans which are usually less expensive than private student loans.

Loans that you may borrow for undergraduate and graduate. The Federal Direct Loan Program is a federal. The Federal Direct Graduate PLUS loan program is used to bridge the gap between the Unsubsidized Loans and the remaining cost of attendance.

For any Federal Direct Stafford Subsidized Loans the interest rate is 34. Status Amount of debt. For undergraduate and graduate students.

Federal subsidized and unsubsidized loan borrowers must meet the following requirements. Your loan servicer will notify you of any interest rate changes throughout the life of your loan. The federal government offers direct consolidation loans through the Federal Direct Loan Program.

Say moving expenses paying interest on a student loan an HSA contribution. The Federal Direct Loan Program is a federal program that provides low-interest. Can I get more loan than what I was awarded.

34 CFR 66832g4 66835c e. Student Loan Debt by Type of Educational Institution. FFEL and Direct Subsidized Loans andor Unsubsidized.

Disadvantages of Federal Direct Loans. Second lowest cost Silver plan is 372 after 589 tax credit. Previously the interest rates were pegged to the 91-day T-Bill 12-month T-Bill or Constant Maturity Treasury CMT.

The Unsubsidized Student Loans interest rate is fixed at 68. With unsubsidized loans you can choose to pay off any accrued interest while youre still in school.

2

2

2

Financial Aid Award Comparison Worksheet Financial Aid For College Grants For College Scholarships For College

How To Read Your Ridiculously Confusing Financial Aid Letter Financial Aid Financial Aid For College Scholarships For College

Pin On Money

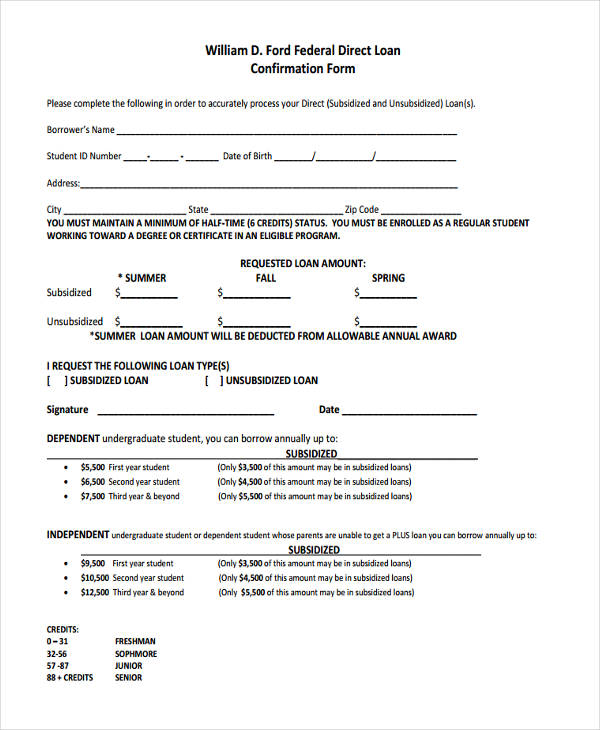

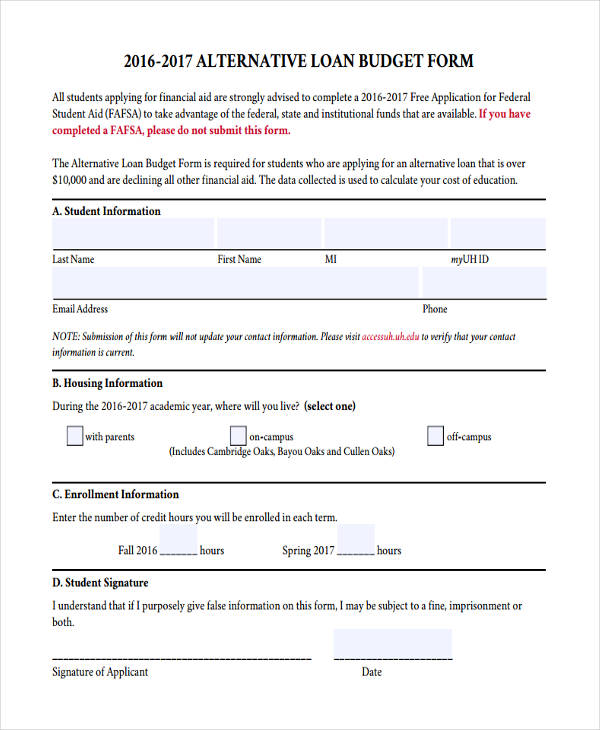

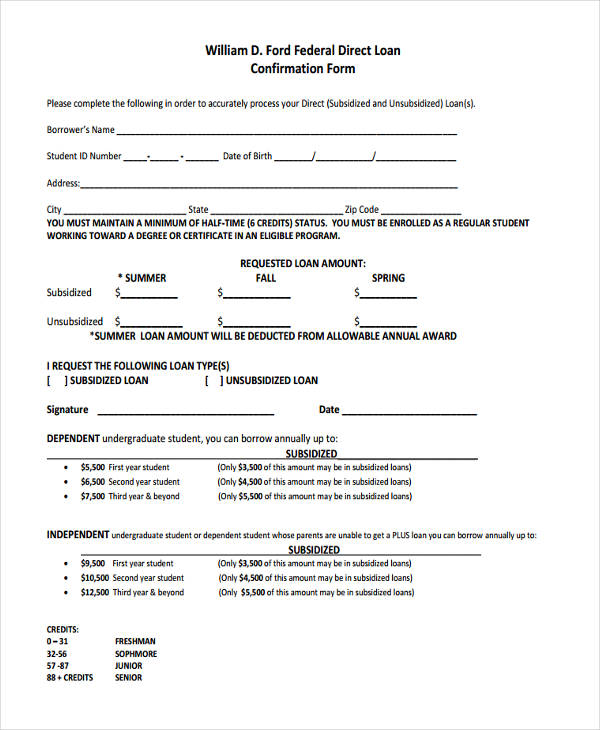

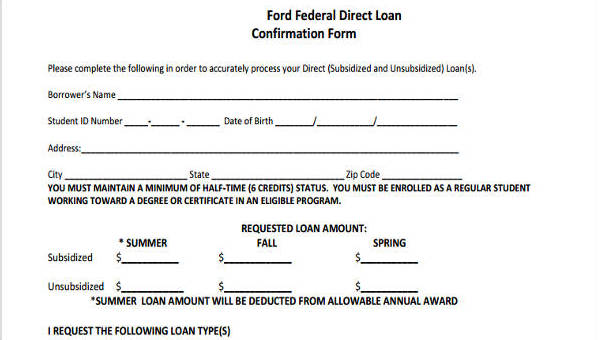

Free 8 Loan Confirmation Forms In Pdf

2

2

Deciphering Sneaky Financial Aid Awards The College Solution Scholarships Financial Aid Scholarships For College

How To Read Your Student Aid Offer Letter 5 Examples Nitro Financial Aid For College Financial Aid Federal Student Loans

Pdf Version Wentworth Institute Of Technology

Free 8 Loan Confirmation Forms In Pdf

2

2

2

Free 8 Loan Confirmation Forms In Pdf